Comprehensive Approaches for Offshore Trust Possession Security Solutions

When it comes to protecting your possessions, offshore depends on can offer considerable advantages. Steering through the complexities of overseas counts on requires mindful planning and understanding of numerous factors.

Understanding Offshore Trusts: A Primer

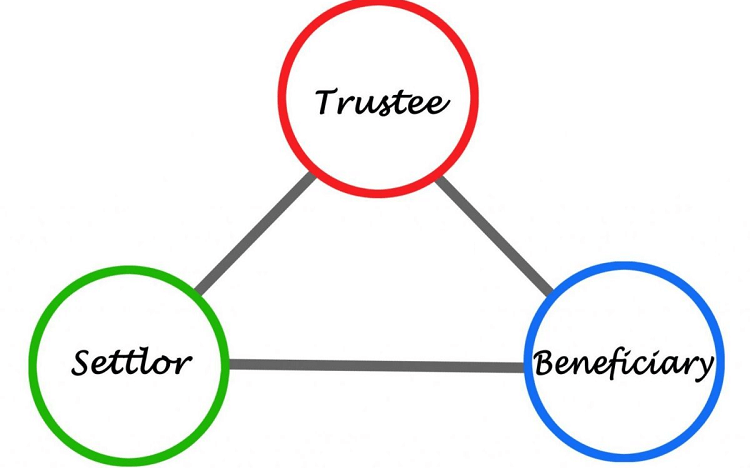

Have you ever before questioned how offshore trust funds can function as a powerful tool for asset protection? An offshore count on is basically a lawful arrangement where you move your possessions to a depend on managed by a trustee in a foreign jurisdiction. This splitting up can shield your possessions from financial institutions and claims. By positioning your riches in an overseas trust, you're not simply safeguarding your properties; you're also getting privacy and possible tax advantages, relying on the territory.

The trustee, that regulates the trust fund, can be a specific or a business entity, and they're accountable for managing the properties according to your guidelines. It's crucial to comprehend the lawful structure and guidelines regulating overseas trust funds in your picked area.

Secret Advantages of Offshore Depend On Property Defense

When you think about overseas trust fund asset protection, you reveal vital benefits like enhanced privacy and tax optimization. These benefits not only protect your assets from possible threats yet also assist you manage your tax responsibilities better. By recognizing these benefits, you can make educated choices that line up with your economic goals.

Boosted Privacy Protection

Exactly how can offshore trust asset defense enhance your privacy? By putting your assets in an overseas trust, you gain a layer of discretion that's tough to attain locally. You can secure your identity because the count on acts as a separate lawful entity, making it much more challenging for anyone to map properties back to you directly.

Tax Optimization Opportunities

While enhanced personal privacy security is a considerable advantage of overseas depends on, they likewise provide valuable tax obligation optimization chances. By placing your assets in an overseas count on, you can potentially decrease your tax concern via critical planning. Many territories offer favorable tax obligation treatments, such as lower earnings tax prices or exemptions on particular gains. You can likewise take advantage of deferment of taxes, permitting your investments to grow without prompt tax effects. Furthermore, offshore depends on can help you take care of inheritance tax, guaranteeing that even more of your riches is preserved for your successors. By leveraging these benefits, you can effectively enhance your tax circumstance while guarding your possessions from financial institutions and legal insurance claims.

Selecting the Right Jurisdiction for Your Depend On

Picking the right jurisdiction for your depend on can significantly influence its effectiveness in asset protection. You'll want to take into consideration variables like lawful stability, privacy legislations, and the level of possession defense they supply. Some territories provide stronger securities against lenders and lawful cases, while others might prefer tax obligation advantages.

Research study the online reputation of each territory and seek advice from with specialists that recognize the subtleties of overseas depends on - offshore trusts asset protection. Try to find locations with well-established legal frameworks that sustain trust law. Additionally, assess the convenience of developing and keeping the trust fund, consisting of any kind of bureaucratic hurdles

Sorts Of Offshore Trusts and Their Usages

Offshore trust funds are available in different forms, each tailored to fulfill certain requirements and objectives. One common kind is the optional count on, where you can give trustees the power to decide how and when to disperse properties. This versatility is optimal if you want to protect properties while enabling for future changes in recipient requirements.

Another alternative is the spendthrift trust fund, created to avoid recipients from misusing their inheritance. It safeguards assets from financial institutions and warranties they're used intelligently. If you're concentrated on estate planning, a revocable depend on allows you to handle your assets while you're active, with the capability to make adjustments as needed.

Last but not least, charitable trusts can supply tax advantages while sustaining your philanthropic objectives. By selecting the best kind of offshore depend on, you can successfully safeguard your properties and achieve your monetary purposes while taking pleasure in the advantages these structures use.

Legal Compliance and Governing Considerations

When taking into consideration offshore counts on, you require Click This Link to understand the legal frameworks in various jurisdictions. Compliance with neighborhood regulations and reporting obligations is crucial to assure your asset security methods are effective. Disregarding these laws can lead to considerable penalties and weaken your trust fund's purpose.

Jurisdictional Legal Frameworks

Steering through the complexities of jurisdictional legal structures is essential for efficient possession security methods. Each territory has its very own regulations controling trust funds, which can significantly impact your asset protection efforts. You need to understand just how neighborhood laws affect the facility and monitoring of overseas depends on. Research study the legal precedents, tax ramifications, and compliance requirements in your chosen territory. This understanding assists you navigate potential mistakes and guarantees that your count on operates legally. Additionally, consider how different territories attend to financial institution cases and discretion. By picking a desirable territory and adhering to its lawful framework, you can boost your property protection strategy and guard your riches against unpredicted dangers while continuing to be certified with appropriate regulations.

Coverage Responsibilities Conformity

Comprehending your reporting responsibilities is important for preserving conformity with legal and regulative structures related to overseas trust funds. You'll need to remain informed regarding the specific requirements in the jurisdictions where your trust fund operates. This includes filing needed documents, revealing recipients, and reporting revenue generated by depend on properties.

Failing to comply can result in large fines, consisting of penalties and lawful difficulties. Routinely speak with legal and tax professionals to assure you're satisfying all responsibilities. Keep exact documents, as these will certainly be vital if your compliance is ever questioned. Sticking to your coverage duties not just secures your possessions however likewise enhances your trust's trustworthiness. By prioritizing compliance, you guard your economic future.

Techniques for Making Best Use Of Privacy and Security

To boost your privacy and security while utilizing offshore trust funds, it's important to execute a multifaceted strategy that consists of careful territory choice and robust legal structures (offshore trusts asset protection). Begin by selecting a territory known for its solid privacy legislations and asset security laws. Research study countries that do not disclose depend on details openly, as this can shield your properties from prying eyes

Following, consider making use of a nominee trustee to more distance your identification from the depend on. This can add an additional layer of anonymity, as the trustee takes care of the possessions without disclosing your personal details.

Furthermore, maintain your depend on files safe and secure and limit accessibility to them. Use encrypted interaction methods when going over trust-related matters, and avoid sharing sensitive information unnecessarily.

Consistently review your techniques and remain notified concerning any type of adjustments in legislations that may affect your privacy and protection. Taking these positive actions can considerably enhance the discretion of your offshore depend on assets.

Involving Professional Advisors for Effective Preparation

While traversing the complexities of offshore depends on, engaging specialist advisors can considerably improve your planning initiatives. These experts, consisting of attorneys, accountants, and financial organizers, bring specialized understanding to the table, guaranteeing you browse the lawful and tax ramifications effectively. They can help you recognize the very best jurisdiction for your count on, considering elements like property defense regulations and tax obligation advantages.

By collaborating with these professionals, you can the original source tailor your trust fund to fulfill your specific requirements and objectives. They'll likewise aid in maintaining conformity with evolving guidelines, which is important for safeguarding like this your possessions. Additionally, advisors can provide recurring support, aiding you adjust your method as your scenarios transform.

Buying expert advice may seem expensive in advance, however the long-lasting advantages, including enhanced protection and comfort, far surpass the first costs. Don't hesitate to look for out skilled experts who can direct you with this detailed process.

Regularly Asked Concerns

Exactly How Can I Guarantee My Offshore Trust Stays Compliant Over Time?

To assure your offshore trust remains certified with time, consistently review guidelines, involve a qualified consultant, and maintain exact records. Remaining notified regarding modifications and adapting your count on as necessary will aid preserve its compliance and effectiveness.

What Costs Are Linked With Establishing an Offshore Count On?

Establishing up an offshore trust entails numerous prices, including lawful costs, management expenses, and prospective tax implications. You must likewise think about recurring maintenance fees, compliance expenses, and any charges from banks entailed in taking care of the trust.

Can I Modification Recipients After Developing an Offshore Trust Fund?

Yes, you can change recipients after developing an overseas trust fund. You'll need to follow the depend on's terms and consult your lawyer to ensure everything's done legitimately and according to your details dreams.

Just How Do Tax Implications Differ by Jurisdiction for Offshore Trusts?

Tax obligation implications for overseas trust funds vary significantly by territory - offshore trusts asset protection. You'll require to research each location's laws, as elements like earnings tax rates, inheritance tax, and coverage requirements can significantly influence your count on's financial outcomes

What Happens if I Pass Away Without Upgrading My Offshore Count On?

If you die without updating your offshore depend on, your possessions might not be dispersed as you meant. This could cause disputes amongst recipients and possible tax obligation difficulties, inevitably threatening your initial estate preparation goals.

Verdict

In recap, steering through offshore trust asset defense can be complex, yet with the ideal approaches, you can successfully secure your properties from prospective threats. Frequently examining your trust fund's compliance ensures it continues to be durable and lined up with your economic goals.